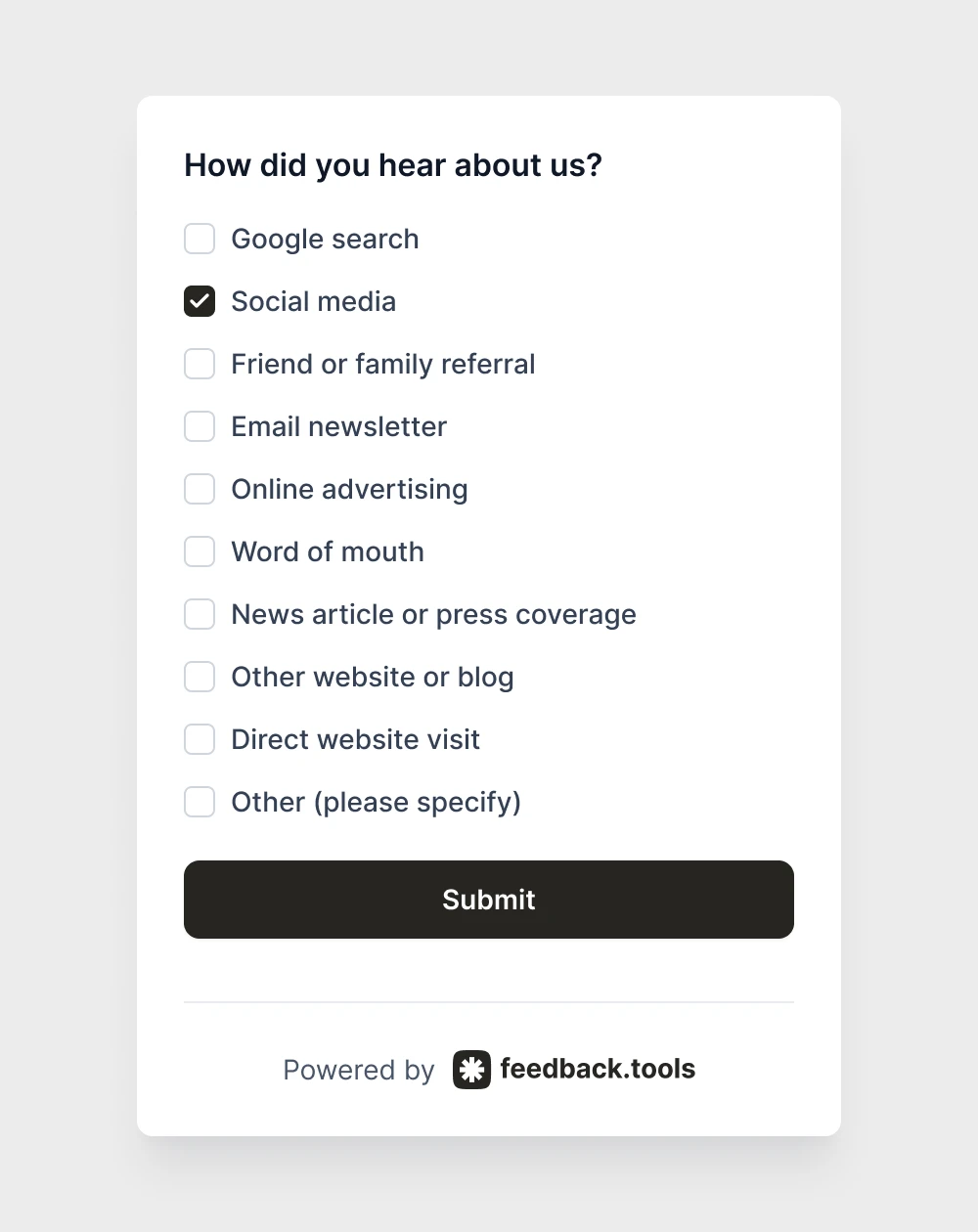

How Did You Hear About Us? Options

A collection of multiple-choice survey options to help you understand how customers first discovered your business.

Product owners know that understanding customer acquisition sources drives better marketing decisions. The classic "How did you hear about us?" question reveals which channels bring the most valuable users. But generic options like "social media" or "word of mouth" miss the nuances that matter most for different industries.

Here's how to craft specific, actionable options that give teams real clusters into their customer journey.

The standard options most businesses use

Before diving into industry-specific approaches, let's look at the generic options that appear on most feedback surveys:

Typical "How did you hear about us?" choices:

- Google search

- Social media (Facebook, Instagram, Twitter)

- Friend or family referral

- Email newsletter

- Online advertising

- Word of mouth

- News article or press coverage

- Other website or blog

- Direct website visit

- Other (please specify)

Why these options feel safe: They cover the basic digital marketing channels that most businesses use. Teams can quickly see whether social media or search drives more traffic.

The problem with generic options: These broad categories hide the details that actually help teams make better decisions. "Social media" doesn't tell you whether Instagram Stories or LinkedIn posts work better. "Friend referral" doesn't reveal whether recommendations happen through professional networks or casual conversations.

Why industry-specific options matter

Most businesses stick with generic lists because they seem universal. But these broad categories hide the details that help teams double down on what works.

A SaaS company needs to know if users found them through a specific integration partner. An e-commerce store wants to track which influencer collaborations drive sales. A healthcare provider should understand whether patients discover them through insurance directories or physician referrals.

When you match your "How did you hear about us?" options to your industry, you unlock clusters that generic surveys miss.

E-commerce and retail

Online stores have diverse discovery paths. Customers might find products through comparison sites, social media ads, or marketplace listings.

Sample options:

- Google search for [your product category]

- Amazon or marketplace listing

- Instagram or TikTok ad

- YouTube product review or unboxing

- Influencer recommendation

- Price comparison website

- Email newsletter or promotional campaign

- Friend or family recommendation

- Retargeting ad after visiting before

- Affiliate or cashback site

Why these work: E-commerce teams can see whether organic discovery (search, reviews) or paid channels (ads, affiliates) drive more conversions. This data helps optimize ad spend and partnership strategies.

SaaS and software platforms

Software buyers often research extensively before making decisions. They might discover tools through integrations, industry publications, or peer recommendations.

Sample options:

- Google search for [your solution type]

- Integration marketplace (Zapier, Shopify App Store, etc.)

- Industry blog or publication

- Podcast or webinar mention

- LinkedIn or professional network

- Software review site (G2, Capterra)

- Recommendation from colleague or peer

- Conference or industry event

- Partner or vendor referral

- Free trial or freemium discovery

Why these work: SaaS teams learn whether users find them through direct searches or trust signals like reviews and peer recommendations. This insight guides content strategy and partnership development.

Healthcare and medical services

Patients discover healthcare providers through insurance networks, physician referrals, and local searches. Trust and credibility sources matter most.

Sample options:

- Insurance provider directory

- Physician or specialist referral

- Google search for local services

- Hospital or clinic website

- Online review site (Healthgrades, Yelp)

- Friend or family recommendation

- Community health resource

- Employer health program

- Emergency or urgent need search

- Social media or community group

Why these work: Healthcare teams can identify whether patients find them through formal channels (insurance, referrals) or informal ones (reviews, recommendations). This shapes marketing strategies and partnership priorities.

Financial services

Financial services customers often discover providers through life events, referrals, or specific product needs. Trust and reputation play crucial roles.

Sample options:

- Google search for [specific service]

- Bank or credit union recommendation

- Financial advisor referral

- Comparison website (NerdWallet, Bankrate)

- Employer benefits or partnership

- Real estate agent or mortgage broker

- Friend or family recommendation

- Life event trigger (buying home, starting business)

- Social media or online community

- Direct mail or local advertising

Why these work: Financial teams understand whether customers find them through professional networks or personal research. This guides relationship-building strategies and partnership opportunities.

Professional services

Consultants, lawyers, and agencies typically gain clients through referrals, networking, or content marketing. Relationship-based discovery dominates.

Sample options:

- Client or colleague referral

- Professional networking event

- LinkedIn or professional network

- Industry association or directory

- Google search for [specific service]

- Content marketing (blog, webinar, podcast)

- Speaking engagement or conference

- Past client re-engagement

- Partner or vendor recommendation

- Industry publication or award recognition

Why these work: Professional service teams can see whether new clients come through existing relationships or content marketing efforts. This insight helps prioritize networking versus thought leadership strategies.

Education and online learning

Students and learners discover educational content through various channels. Course platforms, social proof, and search behavior vary significantly.

Sample options:

- Google search for [topic/skill]

- Course marketplace (Udemy, Coursera, Skillshare)

- YouTube or educational content

- Social media recommendation

- Employer training program

- Friend or colleague suggestion

- Industry blog or newsletter

- Professional development requirement

- Free content or trial lesson

- Online community or forum

Why these work: Educational teams learn whether students find them through active searching or passive discovery. This guides content creation and platform partnership strategies.

Real estate

Property buyers and sellers have distinct discovery patterns. Local search, referrals, and online listings drive most connections.

Sample options:

- Google search for local agents

- Zillow or real estate website

- Friend or family referral

- Neighborhood sign or advertising

- Social media or community group

- Previous client recommendation

- Open house or property showing

- Lender or mortgage broker referral

- Relocation or employer assistance

- Online review or rating site

Why these work: Real estate teams can distinguish between digital discovery and personal referrals. This helps balance online marketing with relationship-building efforts.

Restaurants and food service

Diners discover restaurants through location-based searches, social media, and recommendations. Visual content and local presence matter most.

Sample options:

- Google Maps or local search

- DoorDash, Uber Eats, or delivery app

- Instagram or TikTok content

- Yelp or restaurant review site

- Friend or family recommendation

- Walking by or neighborhood discovery

- Food blogger or influencer post

- Special event or promotion

- Hotel or tourism recommendation

- Work or group dining decision

Why these work: Restaurant teams see whether customers find them through delivery platforms, social media, or local discovery. This guides marketing spend and partnership decisions.

Non-profit organizations

Donors and volunteers discover non-profits through cause alignment, personal connections, and community involvement. Mission-driven discovery dominates.

Sample options:

- Google search for [cause/issue]

- Volunteer matching website

- Social media or community group

- Friend or family involvement

- Workplace giving program

- Community event or fundraiser

- News story or media coverage

- Religious or community organization

- School or educational institution

- Corporate partnership or sponsorship

Why these work: Non-profit teams understand whether supporters find them through active cause research or personal connections. This shapes outreach strategies and partnership development.

Turn clusters into action

Once you collect this data, use it to optimize your marketing strategies. If most customers discover you through professional referrals, invest more in relationship building. If search drives significant traffic, improve your SEO and content strategy.

The key is asking specific questions that reveal actionable patterns. Generic options produce generic clusters. Industry-specific options unlock the details that drive better decisions.

Ready to start collecting better feedback? Install